The ACCRINT function in Excel is a powerful financial tool that helps you calculate accrued interest for securities that pay periodic interest.

Whether you’re a financial analyst, accountant, or simply someone dealing with investment calculations, understanding how to use the ACCRINT function in Excel can save you significant time and ensure accurate interest calculations.

Table of Contents

💰 What is the ACCRINT Function and Why Should You Care?

Before diving deep into the mechanics, let’s understand what makes the ACCRINT function in Excel so valuable.

This function calculates the accrued interest for a security that pays periodic interest, making it essential for bond calculations, investment analysis, and financial reporting.

The ACCRINT function in Excel follows a specific mathematical formula that considers the issue date, settlement date, interest rate, par value, frequency of payments, and day count basis.

This comprehensive approach ensures that your interest calculations are precise and compliant with financial standards.

Many professionals struggle with manual interest calculations, especially when dealing with complex securities or irregular payment periods.

The ACCRINT function in Excel eliminates these challenges by automating the entire process, reducing errors and improving efficiency.

🔧 Understanding the ACCRINT Function Syntax

In Excel, the ACCRINT function has a simple but detailed syntax that covers all the necessary elements:

=ACCRINT(issue, first_interest, settlement, rate, par, frequency, [basis], [calc_method])Let’s break down each parameter to help you master the ACCRINT function in Excel:

- Issue: The security’s issue date

- First_interest: The security’s first interest date

- Settlement: The security’s settlement date

- Rate: The security’s annual coupon rate

- Par: Refers to the bond’s face value, most commonly set at $1,000.

- Frequency: Number of coupon payments per year (1, 2, or 4)

- Basis: Day count basis (optional, defaults to 0)

- Calc_method: Calculation method (optional, defaults to TRUE)

Understanding these parameters is crucial for effectively using the ACCRINT function in Excel in various financial scenarios.

📈 Step-by-Step Guide to Using ACCRINT Function

Let’s walk through a practical example of implementing the ACCRINT function in Excel. Imagine you’re calculating accrued interest for a corporate bond with these characteristics:

- Open Excel and select an empty cell

- Type the ACCRINT function in Excel with your specific parameters

- Press Enter to execute the calculation

- Review the result for accuracy

Here’s a practical example:

=ACCRINT("1/1/2024", "7/1/2024", "3/15/2024", 0.06, 1000, 2, 0)This ACCRINT function in Excel calculates interest for a bond issued on January 1, 2024, with the first interest payment on July 1, 2024, settled on March 15, 2024, having a 6% annual coupon rate, $1,000 par value, and semi-annual payments.

The result shows the accrued interest amount, which represents the interest that has accumulated from the issue date to the settlement date.

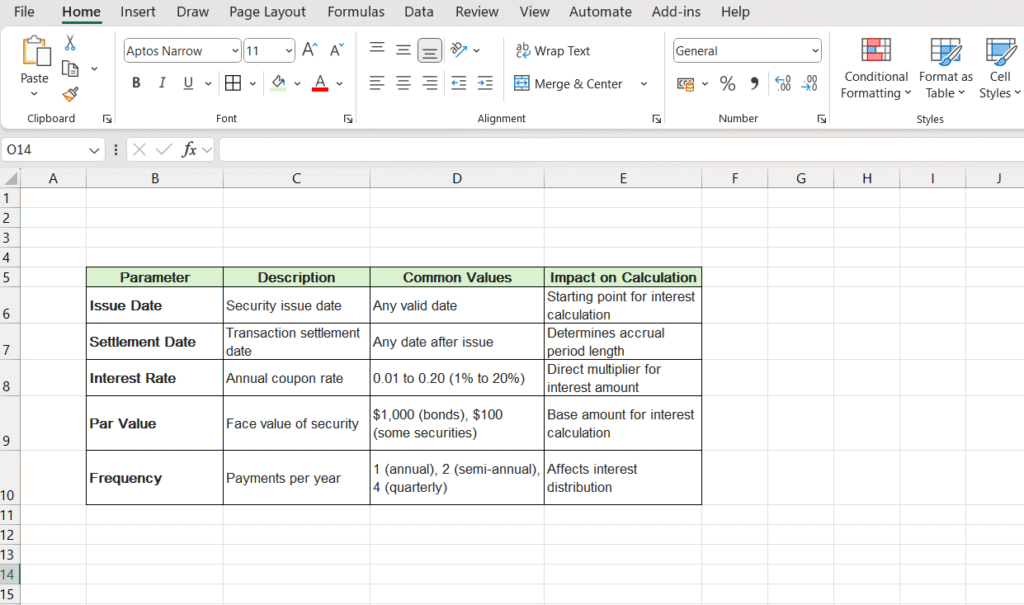

📋 Common Parameters and Their Impact

| Parameter | Description | Common Values | Impact on Calculation |

|---|---|---|---|

| Issue Date | Security issue date | Any valid date | Starting point for interest calculation |

| Settlement Date | Transaction settlement date | Any date after issue | Determines accrual period length |

| Interest Rate | Annual coupon rate | 0.01 to 0.20 (1% to 20%) | Direct multiplier for interest amount |

| Par Value | Face value of security | $1,000 (bonds), $100 (some securities) | Base amount for interest calculation |

| Frequency | Payments per year | 1 (annual), 2 (semi-annual), 4 (quarterly) | Affects interest distribution |

Understanding how these parameters interact helps you use the ACCRINT function more effectively across different financial scenarios.

⚠️ Common Mistakes to Avoid

While using the ACCRINT function, users may run into a few common mistakes that can cause wrong results:

Date Format Issues: Excel requires specific date formats. Always ensure your dates are properly formatted and recognized by Excel.

The ACCRINT function won’t work correctly with text that looks like dates but isn’t recognized as date values.

Incorrect Frequency Values: The frequency parameter only accepts 1, 2, or 4. Using other values will cause the ACCRINT function to return an error.

Basis Parameter Confusion: Different day count conventions can significantly impact your results.

Understanding when to use 0 (30/360), 1 (actual/actual), or other basis values is crucial for accurate calculations.

Settlement Before Issue: The settlement date must be after the issue date. If you reverse these, the ACCRINT function in Excel will return an error.

For more detailed information about Excel functions and their applications, visit www.techtellent.com for comprehensive tutorials and guides.

🎯 Advanced Applications and Real-World Examples

The ACCRINT function in Excel becomes even more powerful when combined with other financial functions.

Professional analysts often use it alongside PRICE, YIELD, and DURATION functions to create comprehensive bond analysis models.

Consider a portfolio management scenario where you need to calculate accrued interest for multiple securities.

You can use the ACCRINT function in Excel in combination with data tables to process hundreds of bonds simultaneously.

Investment firms frequently use the ACCRINT function in Excel for:

- Daily mark-to-market calculations

- Portfolio valuation reports

- Client statement preparation

- Regulatory compliance reporting

The automation capabilities of the ACCRINT function in Excel make these tasks manageable even with large portfolios containing diverse securities.

🔍 Troubleshooting ACCRINT Function Issues

When your ACCRINT function in Excel isn’t working as expected, systematic troubleshooting can quickly identify the problem:

Error Messages: The most common errors include #VALUE!, #NUM!, and #NAME!. Each indicates a specific issue with your formula structure or parameter values.

Unexpected Results: If your ACCRINT function in Excel returns values that seem incorrect, double-check your interest rate format (decimal vs. percentage) and ensure all dates fall within logical ranges.

Performance Issues: Large datasets can slow down the ACCRINT function in Excel.

For smoother performance, you can either use array formulas or split the calculation into smaller parts.

According to Microsoft’s official documentation, the ACCRINT function follows specific mathematical conventions that align with industry standards for financial calculations.

💡 Tips for Maximizing ACCRINT Function Efficiency

For best results with the ACCRINT function in Excel, keep these expert tips in mind:

Use Cell References: Instead of hardcoding values, reference cells containing your parameters. This makes your ACCRINT function in Excel more flexible and easier to modify.

Create Templates: Develop standardized templates that incorporate the ACCRINT function in Excel for different types of securities. This ensures consistency and saves time on repetitive calculations.

Combine with Conditional Formatting: Highlight unusual results or potential errors in your ACCRINT function in Excel calculations using conditional formatting rules.

Document Your Assumptions: Always document the basis and calculation method choices you make when using the ACCRINT function in Excel, as these decisions can significantly impact results.

📖 Related Excel Learning Resources

Take your Excel skills to the next level with these comprehensive guides and templates.

Whether you’re a beginner or looking to master advanced techniques, these resources will help you become more efficient with spreadsheet analysis.

Start with our Excel for Beginners PDF for foundational knowledge, then explore advanced functions like Index Match Formula and Absolute Value in Excel.

For financial analysis, check out specialized guides on Debt Service Coverage Ratio Formula and Profit Margin Formula.

Business professionals can benefit from practical templates including Monthly Sales Report Template, Debt Schedule Template, Real Estate CRM Template, and RFI Template Excel.

Don’t miss our guides on Pivot Table Practice Exercises, Google Sheets Product Roadmap Template, and learn how to Automate Excel Reports for maximum productivity.

📊 Building Dynamic Models with ACCRINT Function

Advanced users can create dynamic financial models that automatically update as market conditions change. By combining the ACCRINT function in Excel with data validation, dropdown lists, and scenario analysis tools, you can build powerful calculators that adapt to different situations.

These models become particularly valuable when dealing with:

- Multiple currency environments

- Varying day count conventions

- Different payment frequencies

- Changing interest rate environments

The flexibility of the ACCRINT function in Excel allows for sophisticated modeling that can handle complex real-world scenarios while maintaining accuracy and transparency.

🎉 Conclusion: Mastering the ACCRINT Function

The ACCRINT function in Excel is an indispensable tool for anyone working with interest-bearing securities.

By understanding its parameters, avoiding common mistakes, and applying it in real-world scenarios, you can significantly improve your financial analysis capabilities.

The more you practice and experiment with the ACCRINT function in Excel, the better your understanding and skills will become.

Start with simple examples and gradually work toward more complex applications as you become comfortable with the function’s behavior and requirements.

Whether you’re preparing client reports, conducting investment analysis, or managing a portfolio, the ACCRINT function in Excel will serve as a reliable foundation for accurate interest calculations.

Take time to explore its capabilities and integrate it into your regular Excel workflow for maximum benefit.

❓ Frequently Asked Questions (FAQs)

Q1: What does ACCRINT stand for in Excel?

ACCRINT stands for “ACCRued INTerest” and is specifically designed to calculate the accrued interest for securities that pay periodic interest payments.

Q2: Can I use ACCRINT function in Excel for bonds with different payment frequencies?

Yes, the ACCRINT function in Excel supports annual (1), semi-annual (2), and quarterly (4) payment frequencies through the frequency parameter.

Q3: What happens if I enter the wrong basis parameter in ACCRINT function?

The basis parameter affects the day count calculation. Using the wrong basis can significantly impact your results. The default is 0 (30/360), but financial instruments may require different conventions like 1 (actual/actual).

Q4: Why am I getting a #NUM! error when using ACCRINT function in Excel?

This error typically occurs when the settlement date is before the issue date, or when you use invalid frequency values (only 1, 2, or 4 are accepted).

Q5: Is the ACCRINT function in Excel suitable for calculating mortgage interest?

While technically possible, the ACCRINT function in Excel is primarily designed for securities like bonds. For mortgage calculations, functions like PMT or IPMT might be more appropriate.

Q6: How accurate is the ACCRINT function in Excel compared to manual calculations?

The ACCRINT function in Excel follows standard financial calculation methods and is highly accurate when proper parameters are used, eliminating human calculation errors.